In 2019, Benefits Data Trust (BDT) partnered with the College Board in an effort to help more students enroll in and graduate from college without burdensome debt by helping to streamline access to financial aid and public benefits.

One result from this collaboration is Wyatt℠, a text message based chatbot that helps high school seniors complete the Free Application for Federal Student Aid (FAFSA). BDT and the College Board made Wyatt available to students participating in the College Board Opportunity Scholarships, a program that rewards students’ efforts to plan and pay for college.

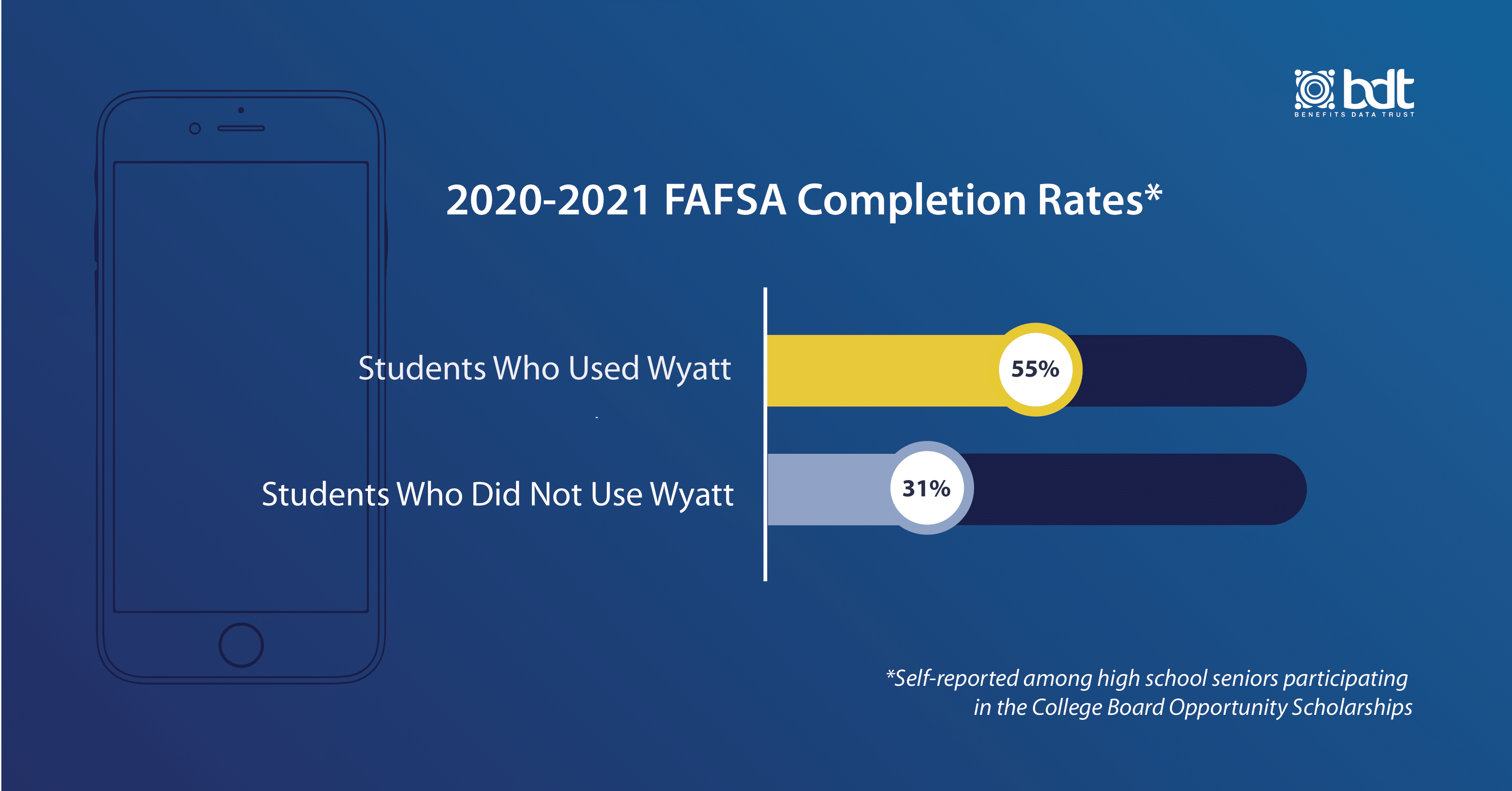

We’re thrilled to share the results of the second year of our pilot, which showed that Wyatt users completed the FAFSA at higher rates than non-users in the scholarship program, and were highly engaged with the chatbot. To help us make sense of the impact, we sat down with BDT’s new Director of Higher Education Innovation, Neeta Sonalkar.

What is the FAFSA and why is it important?

The FAFSA is the gateway to federal grants, work-study, low-cost loans, and many states and institutions use FAFSA data to assess eligibility for their own aid programs. Because completing the FAFSA unlocks financial aid from so many different sources, it is arguably the most important step any student can take in their college planning journey. In fact, 92% of students who file the FAFSA enroll in college by November after graduating from high school, versus only 51% for those who do not.

Despite this, only about two-thirds of high school seniors complete the FAFSA each year, leaving $2-3 billion in federal aid unclaimed — and low-income students are even less likely to file. Research has shown that personalized assistance can greatly increase FAFSA completion and college enrollment and persistence. We built Wyatt to help bridge the gap between students and the unclaimed federal aid left on the table each year.

Tell us more about Wyatt.

Launched in 2019 in partnership with the College Board, Wyatt is the only nationally available tool that provides both reminders and personalized assistance to students completing the FAFSA. A student’s experience chatting with Wyatt is informed by a few key features:

- Wyatt’s dialogue is informed by best practices in behavioral science and by financial aid experts at the National College Attainment Network, UAspire, College Board, and the U.S. Department of Education.

- Wyatt leverages artificial intelligence and natural language processing to recognize students’ questions and gets smarter as more students use it.

- Finally, Wyatt meets students where they are: students chat with Wyatt via text message, a medium they are comfortable with. And we crafted Wyatt’s responses to be as clear and digestible to a high school student as possible. In fact, several students who used Wyatt in our pilot thought Wyatt was actually a real person!

What are some of the results from the two-year pilot?

I’m happy to share that we saw promising results, despite all the challenges that students faced this past year during the pandemic. Not only did the 18,000+ Wyatt users report higher rates of FAFSA completion than the general population of students participating in the College Board Opportunity Scholarships program, but also:

- Wyatt users reported completing the FAFSA earlier than non-users – 43% of Wyatt users completed in October, versus 31% of non-users. Early completion is so important because many states and institutions have early deadlines for their programs and/or disburse aid on a first-come first-served basis.

- Wyatt users’ completion rates outpaced the national FAFSA completion rate, which dropped significantly amidst the pandemic: by the end of February 2021, when the pilot ended, an estimated 42% of high school seniors nationwide had completed the FAFSA, compared to 55% of Wyatt users.

- Students were highly engaged: 68% of students replied to one of Wyatt’s outreach texts, and students who chatted with Wyatt asked about three distinct questions on average.

- Many students interacted with Wyatt in the evening, outside of school or business hours, demonstrating the need for 24/7 support.

- Low-income, Black and Latinx, and female-identifying students comprised more than half of the 18,000+ Wyatt users.

What did students think of Wyatt?

Overall, the feedback we’ve received has been really positive! Students rated Wyatt’s helpfulness as a four out of five on average. Students voiced their feedback, too:

- “I almost couldn't even tell that you were a robot for a bit, and you were able to answer all the questions I had...I got the FAFSA filled out wayyy faster than I would have otherwise.”

- “This is a remarkable tool and it was invaluable to have my questions answered and to be reminded to keep making progress.”

- “Absolutely amazing. I will recommend to my friends and younger siblings.”

So, what’s next for Wyatt?

This coming school year, high school seniors participating in the College Board Opportunity Scholarships program will have access to Wyatt again, and we’ll continue to study its impact. Specifically, we’ll be looking to better understand Wyatt’s relationship to FAFSA completions apart from the characteristics of students who decide to use the tool. Longer-term, BDT is exploring opportunities for Wyatt to help even more students with new partnerships, and potentially help students navigate a broader set of topics related to paying for college. We’re eager to explore where Wyatt could go next!

Are there other higher education initiatives that your team is working on?

Absolutely – BDT recently partnered with two community colleges in Pennsylvania to pilot referral lines to our screening and application assistance services for public benefit programs. The Government Accountability Office estimates that nationally, 57% of college students likely eligible for the Supplemental Nutrition Assistance Program (SNAP) are not enrolled. With input from many others in the field, we are working to streamline student access to SNAP and other benefits, and identify partnerships and strategies to connect more students to assistance so they can better afford healthy food, focus on their studies, and graduate at higher rates without burdensome debt.

How can people learn more or get involved?

I’m always eager to hear from people interested in pursuing this type of work so we can help make finances one less thing for students to worry about. Feel free to reach out to me via email at communications@bdtrust.org.

Even for those not enrolled in the schools with which we have partnerships, BDT can screen and apply students, individuals, and families for public benefits. Visit our website to learn more.